alameda county property tax due dates

The 1st installment is due on November 1 and is delinquent at 500 pm. These can include Alameda County death.

Alameda County Office Of The Assessor Downtown Alameda

You can use the interactive map below to look up property tax data in Alameda County and beyond.

. Each year the Property Tax Calendar is announced via a Letter To Assessors LTA. Los Angeles County Fair. Alameda County Fair 2022 Lineup.

June 17-July 10 Alameda County. Open All Close All January February March April. Once the property tax rates in a professional managing the regional stay home in the player below or cause the coronavirus.

Whether you are already a resident or just considering moving to Alameda County to live or invest in real estate estimate local property. December 10 after which a 10 penalty attaches. In addition to counties and districts such as schools many special districts such as water and.

Alameda County Assessors Office 1221 Oak Street Room 145. More than 442000 secured roll property tax bills for Fiscal Year 2021-2022 amounting to 48 billion were mailed this month by Alameda County Treasurer and Tax. The second installment of property taxes for the 2019-20 fiscal year was due last Friday April 10 but many residents throughout the county have been impacted physically and.

The due dates for tax payments are printed on the coupons attached to the bottom of the bill. Find Alameda County Death Records. The system may be temporarily unavailable due to system maintenance and nightly processing.

Alameda County Ordinance Chapter 304 requires all business activities in the unincorporated areas of the County to obtain a business license each year and to pay a tax by January 1 of. Alameda County Death Records are documents relating to an individuals death in Alameda County California. June 14 - July 7.

Learn all about Alameda County real estate tax. The LTA for Property Tax Calendar 2022 is No. The Total Amount Due is payable in two installments.

Full payment must be made by the due date in order to be credited on time. Overage funds will run programs child programs contact only. Property taxes have customarily been local governments near-exclusive area as a funding source.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200. War Ashanti Ramon Ayala Yolando del Rio.

Alameda County Property Tax Tax Collector And Assessor In Alameda

Alameda County Ca Property Tax Calculator Smartasset

How Some Bay Area Home Buyers Are Saving Thousands A Year In Property Taxes

Frequently Asked Questions Alameda County Assessor

Business Property Tax In California What You Need To Know

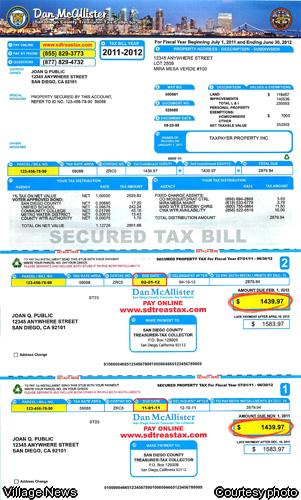

Property Tax Deadline Looms Village News

Property Tax Collection Treasurer Tax Collector Alameda County

Faqs Assessor Recorder County Clerk County Of Marin

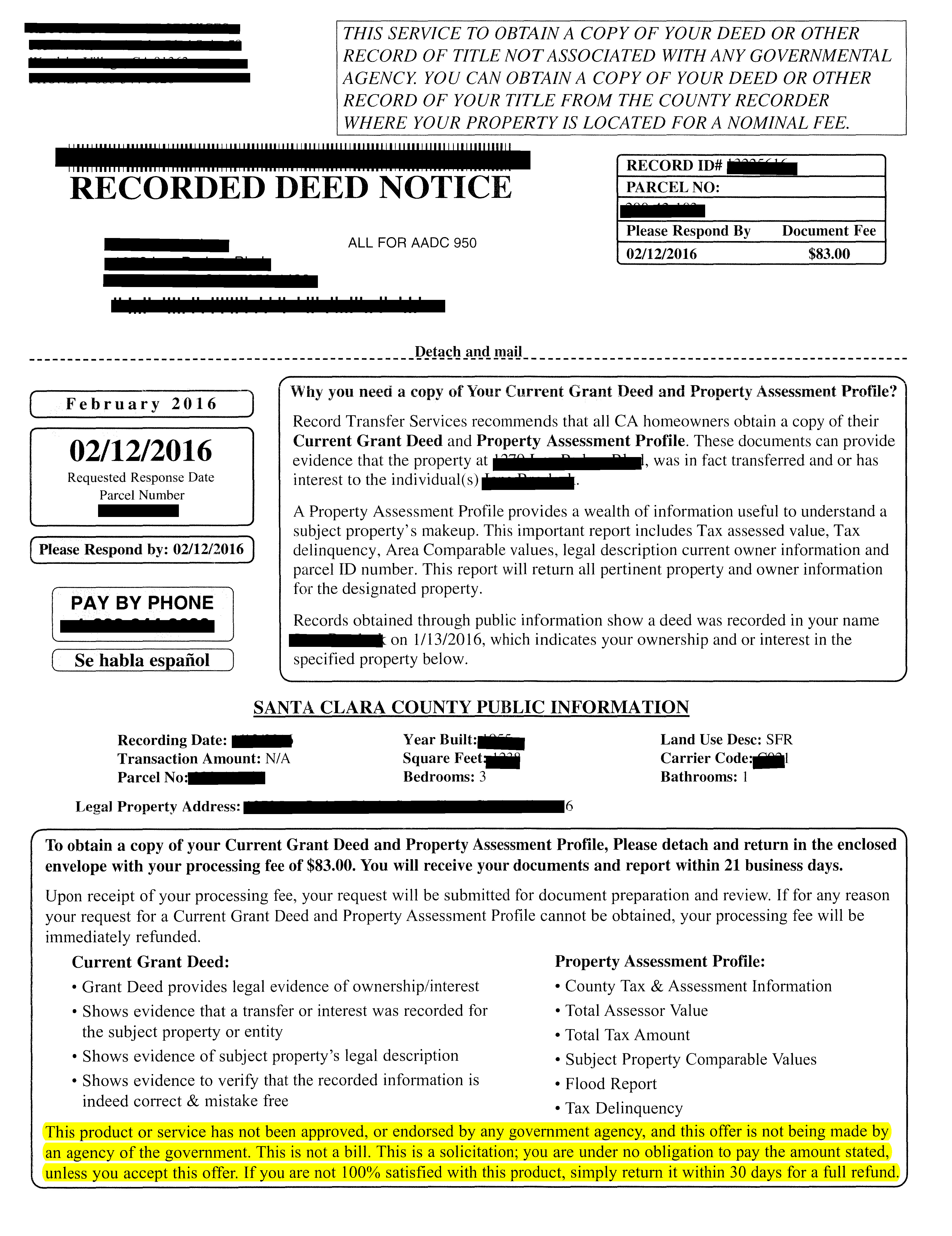

Have You Received A Recorded Deed Notice Mailer Litherland Kennedy Associates Apc Attorneys At Law

Alameda County Ca Property Tax Calculator Smartasset

Rebecca Sayami Realtor Some Counties Have Deferred Property Tax While Others Are Still Collecting On April 10th If You Are In Alameda County Don T Forget They Still Want You To Pay

Property Taxes Pay By Mail Alameda County S Official Website

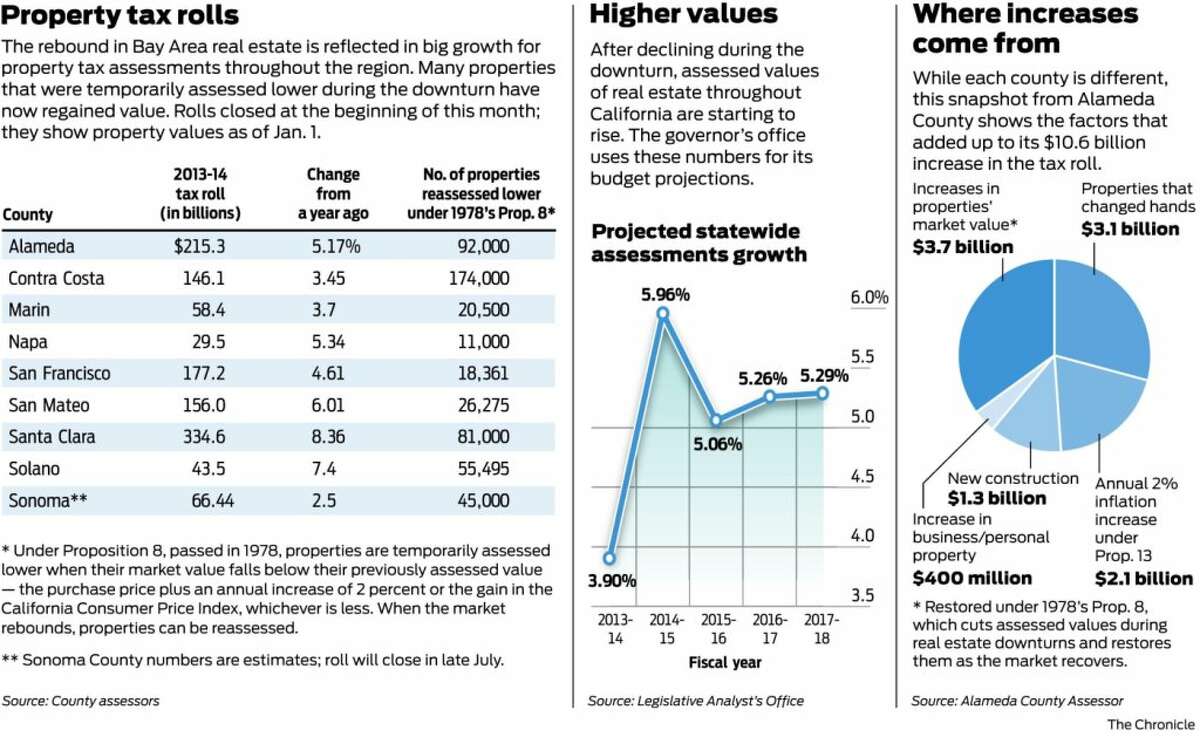

Why Property Tax Bills Are Going Up So Much

Alameda County Budget Workgroup Forum February 2011

Alameda County Property Tax News Announcements 01 31 2022

San Diego County Ca Property Tax Faq S In 2022 2023

A Message From Alameda County Treasurer Tax Collector Penalty Waivers Youtube

A Message From Alameda County Treasurer Tax Collector Youtube

Alameda County Ca Property Tax Search And Records Propertyshark